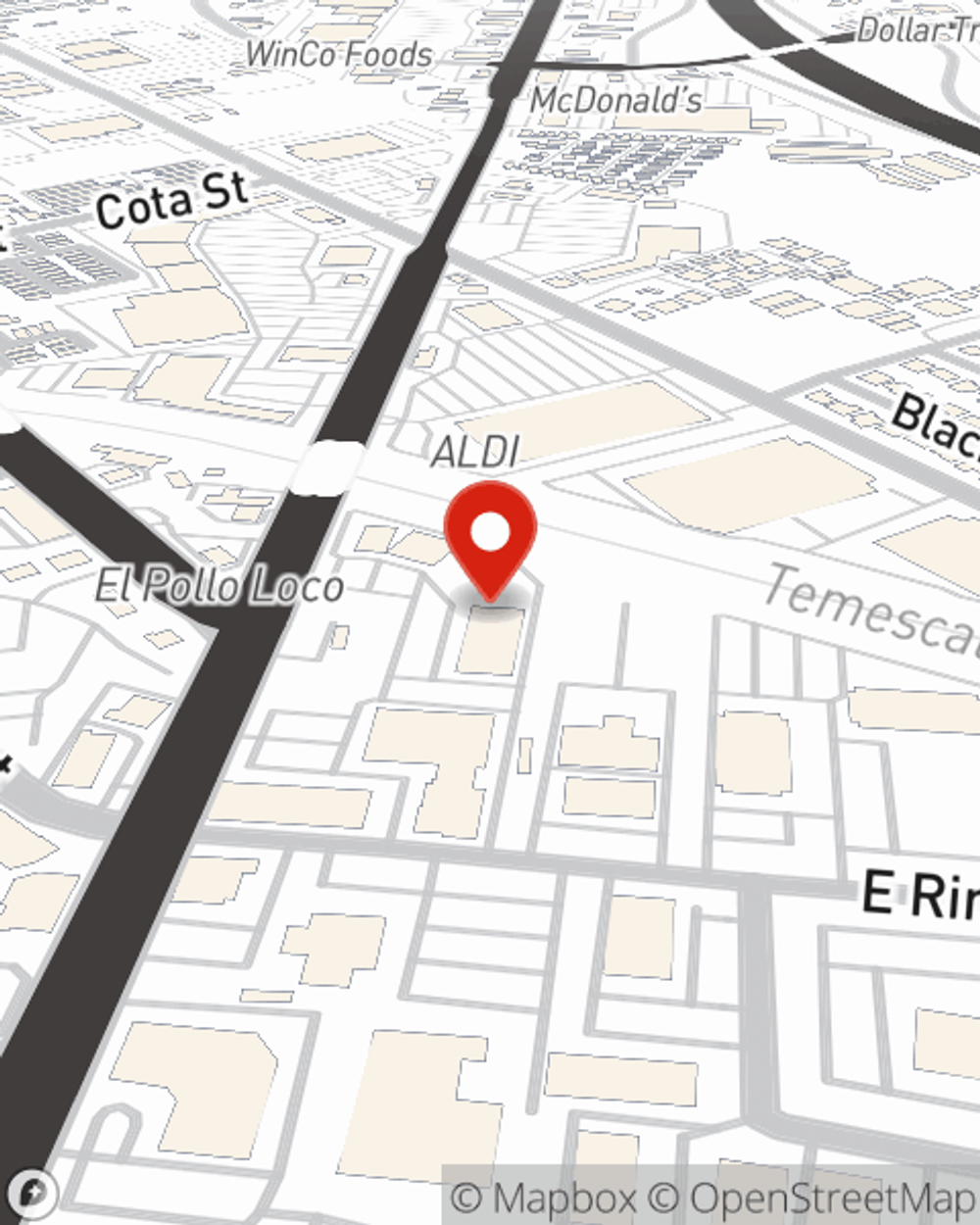

Condo Insurance in and around Corona

Get your Corona condo insured right here!

Insure your condo with State Farm today

- CHINO HILLS

- EASTVALE

- RIVERSIDE

- ORANGE COUNTY

- LOS ANGELES

- SAN DIEGO

- ONTARIO

- SAN FRANCISO

- FLAGSTAFF

- PHOENIX

- LAKE TAHOE

- SACRAMENTO

- SCOTTSDALE

- HENDERSON

- BAKER COUNTY

- BENTON CONTY

- PORTAND

- EUGENE

- SALEM

There’s No Place Like Home

Are you stepping into condo ownership for the first time? Or have you been around the block a few times? Either way, it can be a good time to get coverage for your condo unit with State Farm's Condo Unitowners Insurance.

Get your Corona condo insured right here!

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has terrific options to keep your largest asset protected. You’ll get coverage options to accommodate your specific needs. Fortunately you won’t have to figure that out by yourself. With attention to detail and terrific customer service, Agent Noemi Hernandez can walk you through every step to help build a policy that protects your condo unit and everything you’ve invested in.

Finding the right insurance for your condo is made painless with State Farm. There is no better time than today to get in touch with agent Noemi Hernandez and check out more about your wonderful options.

Have More Questions About Condo Unitowners Insurance?

Call Noemi at (951) 737-1069 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Noemi Hernandez

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.